Creating a will is one of the most important steps in ensuring that your wishes around your estate will take effect upon death. It will help to safeguard your assets and loved ones’ futures. Without a will your estate may not pass to your chosen beneficiaries, and may be subject to significant Inheritance Tax — which could have otherwise been reduced or avoided altogether.

However, what many people are not aware of is that there are certain things you should not include in a will in the UK. Missteps here could lead to disputes, legal issues, or even make parts of your will invalid.

This guide explores what you should never put in your will in the UK and offers essential, expert-led insights to ensure that your final wishes are legally sound and will be respected when the time comes.

Solicitor Catherine Hamilton, based at WHN Solicitors’ Haslingden office and an expert in wills and probate, outlines below five things you should not include in a will.

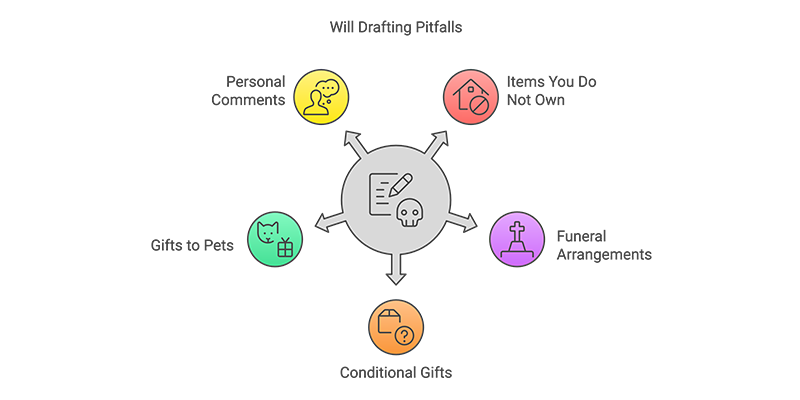

Five Things You Should NOT Include In a Will in the UK

Understanding what you should never put in your will in the UK is essential for ensuring your estate is administered smoothly and according to your wishes — while minimising confusion, disputes, or unnecessary complications. Some items or requests, though seemingly harmless, may not be legally valid, which could create complex issues for your loved ones after your passing.

Here are five examples of what you should never put in your will in the uk:

1. Items You Do Not Own

This might seem obvious, but that is not always the case. For example, jointly owned assets such as a joint bank account or a property owned as joint tenants pass automatically to the surviving co-owner, irrespective of what a will may say.

Similarly, if you own a business with another person or persons, you may not be able to pass on your interest to a different party without the agreement of the other business owner(s).

Assets that you do not own outright — such as a leased car or goods bought on a hire purchase agreement — are not usually able to be gifted and should not be mentioned in your will. In addition, pensions or life insurance policies which are nominated to pass automatically to a beneficiary should also not be included in a will.

2. Why Funeral Arrangements Should Never Be Put in Your Will in the UK

While it is quite common and perfectly reasonable to state a wish to be buried or cremated in a will, these wishes are not legally binding due to their advisory nature. Executors are not legally obligated to follow funeral instructions outlined in a will, meaning such wishes may not be enforceable. Furthermore, as sorting out funeral arrangements is one of the first things to happen after death, your funeral could even be arranged before anyone has actually looked at the will.

For both these reasons, it is always better to discuss any particular requests you may have regarding your funeral with those family members who are likely to be making the arrangements. The other advantage is that if you change your wishes for your funeral, you don’t need to change your will or risk your family following what the will states.

3. Be Cautious About Including Conditions in Your Will

Generally speaking, it is not advisable (though not illegal) to try to apply conditions to gifts in your will. While it might be reasonable to state an age for a grandchild to inherit, or make a gift to the spouse of your child on the condition they remain married, making a gift conditional on someone not marrying a particular individual would almost certainly not be reasonable.

Putting conditions on gifts risks disputes arising after your death which can be costly and delay the estate being finalised. Examples of such disputes may include:

Disagreements over eligibility to inherit

Challenges to the interpretation of specific conditions attached to a gift

4. Why You Can’t Leave Gifts to Pets in a Will

It is not possible to leave a gift to a pet in your will as animals cannot own property. However, you can state your wishes as to who is to care for a pet after your death (you should always speak to them first to make sure they are willing) and you may wish to set aside a sum of money to assist that person in caring for the pet.

5. Avoid Personal Comments or Explanations

On death, particularly if your will goes to probate, it becomes a public document. This means anyone has access to read it. As a result, your will should state who inherits what —– but not state who has been excluded,is not included or the reasons why.

If you have excluded people from your will who might have expected to be beneficiaries of your estate, this should be addressed in a separate document which can be produced after death if required, but otherwise remains confidential.

See also our blog post: How to avoid any challenges to your will.

Common Mistakes to Avoid When Writing a Will

It’s surprisingly easy to overlook key rules when it comes to the drafting of your will. Simple errors — such as including assets that automatically transfer, or attaching unreasonable conditions to gifts — can complicate the administration of your estate.

For example, including an asset like a jointly-owned property, can create additional layers of confusion for the surviving party. Similarly, unreasonable conditions attached to gifts may lead to damaging disputes or legal challenges, potentially causing a rift between those you hold dearest.

By ensuring your will is legally compliant and clearly drafted, you can help save your loved ones from any unnecessary stress and complication.

Legal Consequences of Including the Wrong Things in a Will

Failing to follow the guidelines of what you should never put in your will in the UK can result in costly disputes, delays, or even parts of the will being rendered invalid. For instance, improperly specifying jointly owned property or attaching unenforceable conditions to gifts can result in legal complications.

Family members may also face drawn-out probate processes or challenges to the estate, which can cause avoidable emotional and financial strain. Seeking professional guidance when drafting your will can help mitigate these risks.

Safeguard for the Future

The best way to ensure that your will is legal and in accordance with your wishes is to have it drawn up professionally. It is also important that you regularly review your will — experts often recommend doing so every three to five years, or when a significant life event occurs (marriage, divorce, birth of a child, etc.). This is important as it ensures your will remains relevant and aligned with your current wishes.

WHN’s wills, probate, and trusts team, working across all our offices, has a wealth of expertise in this area and can ensure you have done everything possible to safeguard for the future.

See also our blog post: Five reasons why you need to update your will

Ready to ensure your will is clear, compliant, and reflects your true wishes? Catherine Hamilton advises WHN’s clients on issues related to wills, probate and powers of attorney.

If you wish to prepare a will or update an existing one, contact Catherine on 01706 213356 or by emailing catherine.hamilton@whnsolicitors.co.uk.